APE TAX System Design 🦧🦍

A mathematical-analytical way of retaining value for crypto ecosystems.

For any system to sustain and grow, it needs to have a positive feedback loop. Why do you think VCs do all this well-being stuff with founders? Well, obviously, to gain an edge and get into the best rounds. But next to that, they also realize that you have to make your surroundings flourish - that contributes back to the environment you live in, your own safety, and so on. Being Ethical Is Long-term Greedy © random dude

The same is true for crypto investments: when you ape and make a lot, you should consider contributing to gitcoin. Why? Because it’s a selfish rational way to make more people work, innovate, and thus grow the ecosystem as a whole. This is how you can consciously contribute as a rent-seeking zero-sum actor, as 99% of us are.

But this is a self-enforcing solution to the free rider problem…

How do you tax not just free-riders, but value-extractors?

There is no crypto ecosystem tax that keeps the ecosystem self-sustaining. For instance, Bitcoin’s design is too simplistic in a sense that it is just a pyramid structure: early adopters get rich. Hey-hey, I am not shitting on the daddy, please hold on there! I am saying that there are more nuanced ways of taking advantage of growth for the sake of helping the engine run faster and longer. Let’s look at some.

But before we do that, what were the ways so far for projects and developers to use the bull market and extra attention for? To raise more money and then give out grants. Or to sell some of their holdings - and again do grants or self-sustain to innovate… boring.

bull market -> price moon -> sell -> give grants -> … ?

In both cases, it’s done at the expense of the ecosystem’s health, where community members either get somewhat rekt as the central bank [the team] takes their premium and sells into it [selling foundation or team tokens when price is up]. The choice of when to sell, how much, how quick or who to give grants to - is super subjective and is not really token holder oriented. We can do better? Oh ye!

PS: I made 100 mistakes with the explanations below, please correct and cancel me.

MakerDAO - MKR

DAI was above the $1 peg for a few solid weeks during the beginning of the summer bull. To keep the peg, they kept lowering the fee to 0% [easier to print more Dai, which you can go and sell at premium] - but then still it didn’t help. So what did they do? They just increased the fee. If you can't fight it - profit from it.

As such, MKR revenues are currently one of the highest among DeFi protocols. This can be seen as a way to embrace the speculation and say “we accept it as it is, long-term this is better for MKR holders anyway” instead of just fighting speculation. Use degens to benefit the system. Basically, in this case token holders keep all their shares and get fees for their ecosystem, growing with the trend and not fighting it.

Nexus Mutual - NXM

There has been an argument about NXM’s 100-130%% ratio [beyond 130% it goes to the insurance pool, and below 100% you can’t withdraw NXM]. The infamous degenspartan was voicing a pretty clear argument of "when it goes down 100%, you can't withdraw your ETH anymore, so you only rely on secondary market liquidity of wNXM" - which is true. Here is more. And as such, its idea of the price being mathematically supported (bonding curve) stops. So is that bad for people?

Not really. Degens, looking for a quick profit and aping beyond 130%, actually help the capital pool to grow. And you are in it for the long-term, you simply wait out for the ecosystem to grow beyond 130%. And if you are not… well, you can wait or just go take a possible loss on the wNXM side. Thanks for making insurance more accessible!

So you can replicate similar models where aping actually is good for the long-term value and product side, which flourishes as a sub-product of the aping.

As for the solution APY (insurance payments paid on covers) Hugh responded with ideas on how to re-capitalize the pool for many other needs and thus increase the APY the base pool makes because it's obvious that 2% or so "insurance" payment on the entire pool is not nice, and it needs other ways (which they are working on).

Keep3r Network - KP3R

KP3R doesn't have supply inflation beyond the work credits you provide. So let’s say I am a company: I post a job and bond liquidity for 14 days in the form of ETH-KP3R. Somebody takes the job and gets those KPR credits. They can 1:1 redeem it to USD.

First of all, why not use another token? Well, the bonding liquidity looks nicer on a company balance sheet who posts the job. And if the worker(s) sometimes do not redeem credits - companies can unbond liquidity. Then who pays… Basically, degens pay for adoption. Essentially, it can happen that some companies unbond liquidity and degens pay for the work and the product.

Next to that, the initial treasure pool Andre seeded the project with [which is over 5M USD] + the fees from Uniswap trading go to the starting balance sheet.

Yearn Finance - YFI

No intro here needed! The new fee structure benefits long-term building and welcoming innovation to the ecosystem. Instead of just giving money to shareholders (owners) it gives money to stakeholders (workers+owners). All perfectly said here.

KeeperDAO - ROOK

KeeperDAO utilizes the capital pool to get into flashloan-arbitrage game. However, this also creates a tragedy of the commons problem where too much TVL = low utilization ratio = low APY on the fees generated from the protocol itself.

The same way a hedge fund doesn't need more and more money as the opportunities are sometimes limited and beyond point X more capital is actually bad. Like being a VC in crypto with 50M USD and having to deploy into shit, just because you have to.

Anyway, new deposits pay ape tax 0.64% to previous LPs, creating a little pyramid for getting the system going. This isn't a novel model as it was used before many times. Next to that, you can see it as a zero-sum ape tax as it doesn't necessary help the system, unlike in MKR case. Here it just gets people to join, and doesn’t improve the protocol or the long-term solution liveliness. This is an example of a pyramid tax rather than an ape tax, because only degens profit from degens, not the system.

In all such cases, degens are not rekt by default. Degens can still profit a lot. But whether they profit or not, systems can accrue value mathematically and organically, while all rules are on the table. This is different from raising and giving grants, because grants are very subjective. Here it's a default feature of the system.

Programmable money… muh programmable systems? Yes ser.

You can also say that lending protocols are similar in this regard. Like if I am to pay 5% interest rate on my position, while lending the new asset for 3% back… I am likely dumb, right? Well, yes but - the farmed COMP or whatever it is - can actually offset the difference. As such, short-term price could be in trouble, but the system constantly accrues fees into the treasury. Which is the idea here: long-term alignment!

Ape tax done well ->

You don’t have to sell tokens in uptrend, you retain ownership as a holder;

Ecosystem as a whole retains value and grows, as well as the treasury;

Long-term developer innovation is incentivized organically;

Tax game is known and is clear, all is transparent. No team decisions.

The name of the article and the idea is taken from the CRV ape tax vault. But tbh, I wouldn’t call that one a tax really. It’s a non-parasitic contribution, rather than a tax.

Let’s give it a name, shall we!

Ape Tax is referred to as a commission automatically taken from a degenerate investor in favour of the ecosystem (less so another market participant). A commission can be seen as a loss on a trade, a fee paid to the system, slippage, or represented in other forms. It mainly occurs in cases of FOMO and rush, where the ape doesn’t have the time or the care about the situation. Usually due to being rich.

Other things to talk about…

Fuck brainless forks and muh “Fair Launch” memes.

YFI fork number 17… Curve fork number 5… So boring. Pure value extraction, zero innovation or actual competition. It’s all more or less the same narrative charade with “ser zero premine”. Same as Bitcoin forks did back in the days.

Well, things can’t continuously innovate without aligned incentives, so putting devs at risk of huge funds and not paying them is not smart. And if things develop and keep growing, everybody is happy to pay ape tax and incentivize the machine further.

A different “fairer” distribution doesn’t make the product better. Yes, it gets you some eyes, but unless you are genuinely unique - it’s worthless.

While anon farm-incentivized projects are 99% shit, some have been doing some cool things. Not that I endorse their tokens in absolutely any way [AT ALL], but CORE and Dracula did interesting experiments and gamification designs at least.

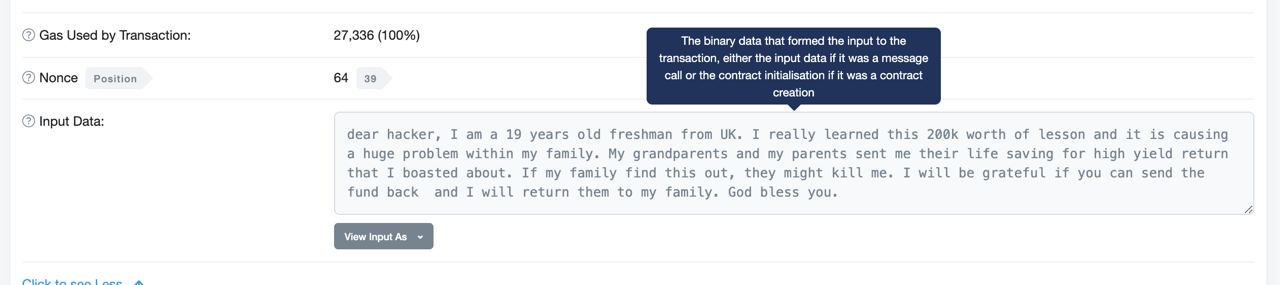

Then you get hilarious things like this:

Random thoughts, non-structured…

It has been a while since the last newsletter, due to the farming season. But also the quality of projects has been forever-declining as many opportunists join to just copy concepts and deploy them on polkadot. I am still missing a lot in my research, like…

How do you call a project which gets into a new population segment (be it music or art) and onboards creators & developers - but clearly has a terrible token design system and not necessarily a company? It’s purely a shitcoin. Even close to a scam, speaking from the design-marketing perspective of its asset. But it does work on growing the crypto ecosystem, so it’s not inherently bad… anyway, many of such.

Anyway, subjectively, some of the cool things are:

Continuous YFI innovation by their awesome community;

CRV being in the centre of all flashloan attacks and getting cool veCRV fees, yet again proving how awesome the system they built is and their 200 IQ levels;

Fixed rates lending like Notional Finance & some thing endorsed by Stani;

Liquid staking - especially with ETH 2.0 launching - next to Rocket Pool, gets prolifirated by StaFi, Lido, Darma, and a few others.

Options, Leverage, Derivatives: by YFI itself, Hegic, Perpetual, Oiler, and a hundred others. No clue how to analyze this particular sector properly, it’s so early that nothing can really be said.

Not much new otherwise. Insurance projects pretty much copying Nexus Mutual, a bunch of YFI forks with fake promises and worse APYs, plenty of papers on LP tokens liquidations for collateral usage, and so on. As for the NFT trends, nothing different I see now from what we touched upon last time. I guess Zora, NIFTEX, Foundation, and some others - do interesting stuff that’s unique.

Approaches with voting-indexes like CVP or Index are interesting as they activate politicians as well as further resemble real-world [with $ sharing].

I like the organic approaches with DAO-oriented marketing, the tech approach like Marlin & HOPR, and interesting incentive designs. Never mind, just shilling some of my bags. That’s just from the top of my head, there are dozens more.

There is a lot more to talk about, and things change very fast..

That’s it for today. As always, we are mostly Telegram deep sea dwellers, so find us there. Here is the channel with all the relevant links for you to check.

Happy swimming!