The next round must be priced higher! "Evolution" of token raises. NuCypher's WorkLock & UMA.

It is getting really hard for token projects to raise next rounds at higher valuations. This is also a problem for older projects that are now trying to go liquid. What to do?

Welcome to the new Lobsters Research 🦞

Today we have something highly observational-speculative, so I hope you are in the mood for thinking. To start if off, I would like you to contest the following:

statement #1Altcoin crypto markets are fully driven by retail: not pension funds - but random traders like me, you, and your dog. That implies a high degree of fomo, gambling, and general lack of due diligence. Deriving from that, a project abstaining from making its asset liquid is depriving itself from community exposure. All the people who would have potentially wanted to engage, speculate, or do whatever their mind desires - are not paying attention to you.

This might change at some point in the future if utility tokens start getting more usage. But for now, all assets are at over 100x multiplier of their utility. Therefore, talking about value applies to long-term holders only.

I acknowledge that there are different strategies with regard to timing liquidity. Some projects, especially VC-funded, prefer to stay “behind the scenes” while building - but that’s another topic. I will try contest that theory in the following blogs.

Thus, we can establish that it is imperative to reach liquidity. Moving on.

With the retail pepe is crying, private sale gets rekt too

Back in 2017 when the market had way too much money and altcoin valuations were being priced significantly lower than what the market was ready to pay - there was just one launch with one price. Then the price mooned further and it was all great 🦄

Soon after, such profitable “inefficiencies” were quickly noticed and extracted. In fact, it was more so that the market started going south. Money became harder and harder to attract, and it’s still getting worse for projects trying to raise money.

While the downside of investments is at 100% - the upside is capped due to lower retail activity, now requiring a much more lean approach from teams.

Investment activity has significantly slowed down, with mostly seed rounds occurring now. With models emerging based on downside protection [1 & 2], we can see in the future the model turn into pure lending. It’s all getting back to “normal”.

Lobster, what’s the point here? We all know this!

Right, that was quite a long introduction into the topic.

What we see is that it’s significantly harder to boost the valuation of the next round. Previously you could see people buy x5 with large volumes. Now you can still sometimes see it, but with volumes being significantly lower.

Save the retail pepe, he is the driver of volume

So projects & investors are stuck with the question:

statement #2There is almost no demand now to buy private sale bags. The only actors left are the seed round [either smart insiders or long-term believers] and retail fomo. You have to either adjust the valuation into super low, experiment further, or be rekt.

As per the chart below, Perlin was a weird outlier with absurd numbers, while Wink was Justin Sun’s game hence it was allowed a higher valuation. In general, you can see a lower valuation trend and longer lockups all across the board. It’s a general market tool these days. Lower caps have higher upside to grow, which is more attractive for exchanges.

So how do I make my next round after seed look higher?

One of the ways to do it - is to adapt to the market and not overprice your whitepaper. If you are trying to fundraise right now and don’t know a16z personally - then maybe lower down your appetite. Adapt the valuation and be more lean.

Or you can try to game the psychological price levels…

NuCypher’s WorkLock: Psychological Price Level

Ok, time for concrete numbers! So when no one will buy the next round at even +20% of your previous round - but you still have to get that public exposure and distribution - what’s the way to go? NuCypher (for ethical/legal reasons though) came up with a wonderful model - WorkLock. You do work and get free tokens, yes sir!

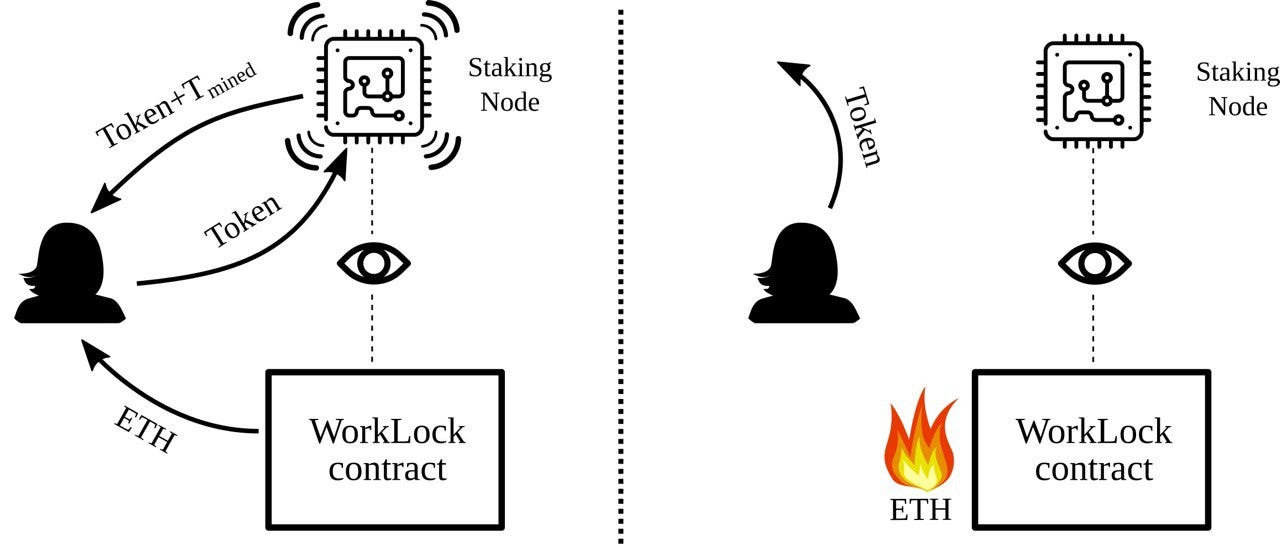

Participants in the token distribution escrow ETH into a smart contract where it is locked. In return, they receive tokens. Over months, both their ETH and NUtokens get released.

See it as reverse auction. While an auction tries to get the retail rekt by making them fomo-overprice the last round, WorkLock does the same effect to the price but for free. Therefore, it’s a much more friendly public distribution model. It’s not effectively fundraising any USD for the project, it’s only a distribution model.

Let’s look at something cooler:

NuCypher has previously raised around 15M USD. That is clean cash available to them to work on the project and develop the ecosystem. But how does one keep up the valuation of 130M USD? That would be quite hard as we discovered above…

NuCypher allows anyone to send in ETH, work by staking the received NU - and eventually get it all back. This way, the amount of ETH being sent - if exceeding the mark - can boost the psychological valuation much higher. Making it the bottom line for retail to engage in when it comes to open market trading. Hypothetically.

It’s a double-down game though: if somehow the amount of ETH locked is lower than the price of the token of the last SAFT round, it would be hard to demonstrate secondary market demand. I am pretty positive they’ll make it though.

With the release happening via staking months after the start, and private sale having yearly vestings - this could be a good example of how token release could lead to a less negative price performance, where slow new demand counters the effects of selling.

UMA Protocol: Low-Liquidity Price Boost

While NuCypher does not impose risks on retail to boost its valuation, UMA’s Uniswap listing did exactly that. I am not saying it is bad or something, every model has its tradeoffs. It’s definitely an interesting approach from them.

The “initial price” of 0.26 USD could not be taken due to how curves at Uniswap work. There was about 1.5M USD of interest in the first minutes when the pool was deployed. Part of that got in low - part got muhc higher. See the numbers below.

Whales 2ho got the average price of 2-3x liquidated into buyers over 4X right away. Meaning those that bought after 4x are either break-even now or are actually below their buying price due to no extra liquidity being introduced to UMA now.

You can check the dashboard here.

Since the price is now staying at decent levels, one could make a case for the valuation to be cemented up until new large distributions come. However, if the demand will catch up with gradual releases - this could be a decent way.

statement #3These models incentivize previous round participants to double down and help projects keep the price level higher - without imposing any risks on the additional capital. You can hedge the ETH you supply as a Uniswap LP or as NU staking requirements, thus reducing your exposure to volatility. Win-win.

I expect to see more innovative models trying to attract community attention. The stakes have long been turned around: now with projects asking for money and attention. With the equilibrium coming to more realistic numbers, we might see the light at the end of the tunnel where value can actually drive price to some extent.

That’s it for today. As always, we are mostly Telegram deep sea dwellers, so find us there. Here is the channel with all the relevant links for you to check.

Happy swimming!