There ain't no such thing as free APR © Reverse-engineering professional validators and brrr.

Why is staking still going forward and who pays for lunch? How to get the top validators to your network and should you even care? All trends staking ahead!

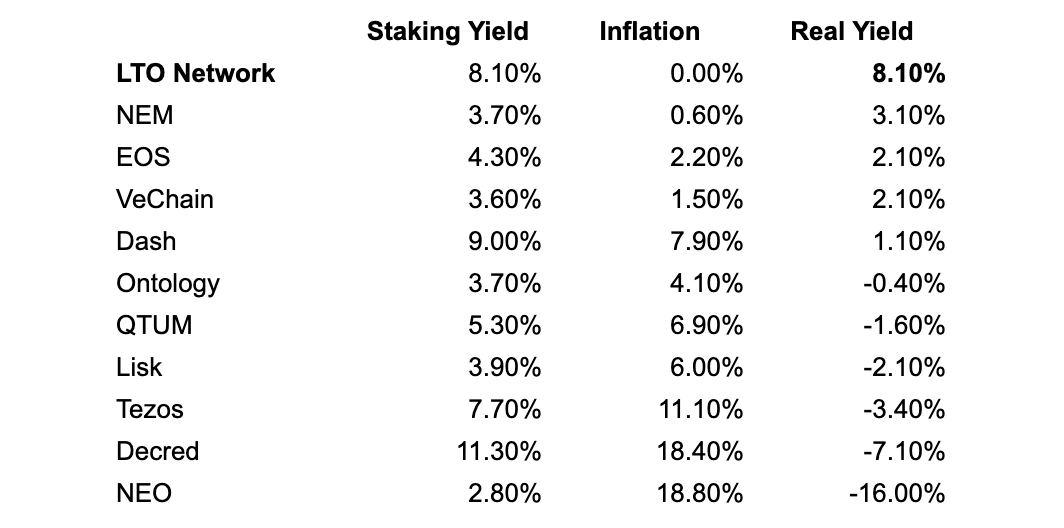

It’s funny to see crypto people make fun of the fiat printing machine, while staking APR or APY (annual percentage rate, or yield) is not much different from that.. or is it?

You could argue that staking is intended to bootstrap the network security, community, adoption… and you would be right. However, the intentions of the fiat machine could also be pure (foster consumer spending habits, sponsor real estate projects for new housing) - but in both cases the trickling down effect doesn’t happen. Surely, you subsidise network security (more staked means more secure) but there is barely any usage to take advantage of that security. Putting that aside, wealth eventually accumulates in very few hands. And this is how anything works (information, resources) so let’s not waste time trying to re-define physics.

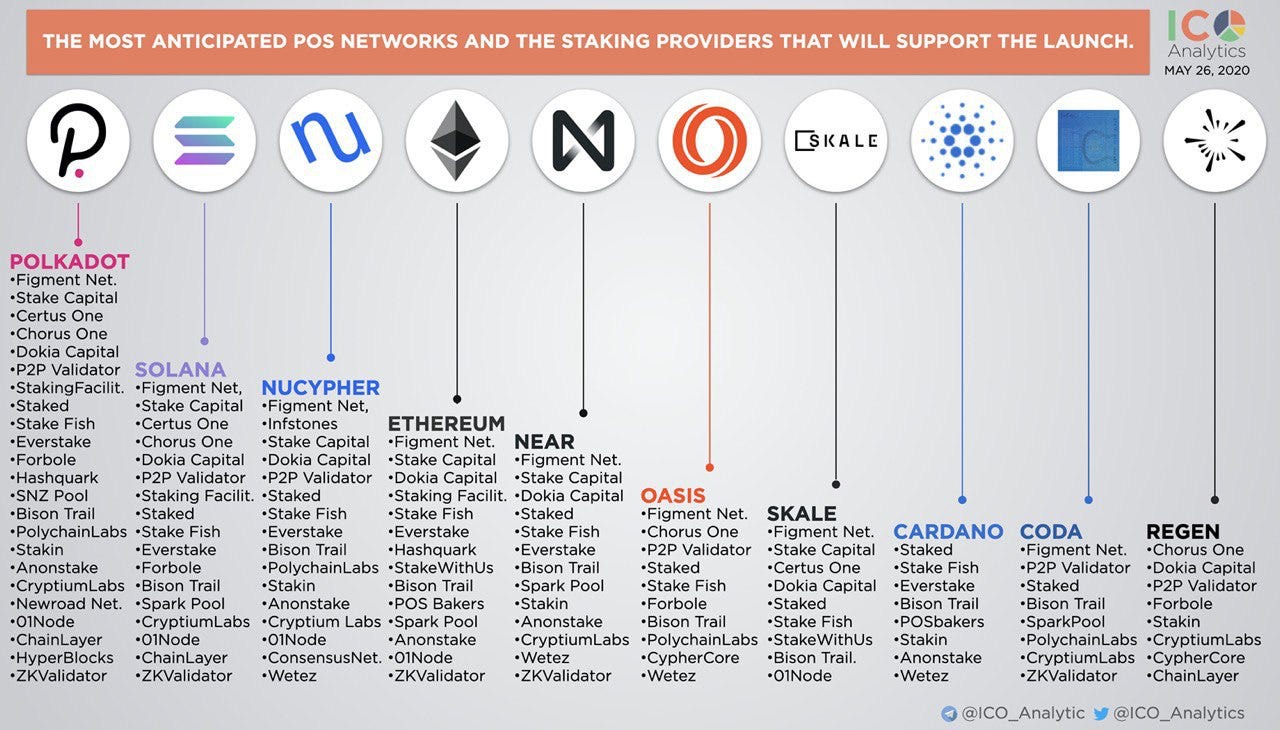

But there is more to it when it comes to professional validators: P2P, Figment, Stake Fish, Chorus One, Bison Trails, Staked, Stake Capital, and other cool teams. While trickling-down effects do not happen, the services such providers bring could be very beneficial for blockchain networks and their tech communities.

PS: TL;DR of the article on reverse-engineering is in the middle of the article. You can ctrl+f on “the sauce of article” and just read the extract with a calculation. Let’s go!

Why is staking growing?

Because staking is beneficial for every actor involved in a project:

Projects: easier to convince investors to load money into a work asset

Investors: justifying “passive income” to LPs and putting assets to use

Early members: getting more coins at the expense of non-working holders

But most importantly, service providers. It’s continuous cashflow.

Beneficial to everyone … except the people who will be either late to the staking game or invest close to networks becoming irrelevant, basically devaluing. But nobody can predict when the latter could happen, so it’s pointless to argue on it.

Obvious statement #1

With staking, you essentially create more money at the expense of future buyers (growth) or non-working holders as their % of owned supply goes lower.

So where does that money go?

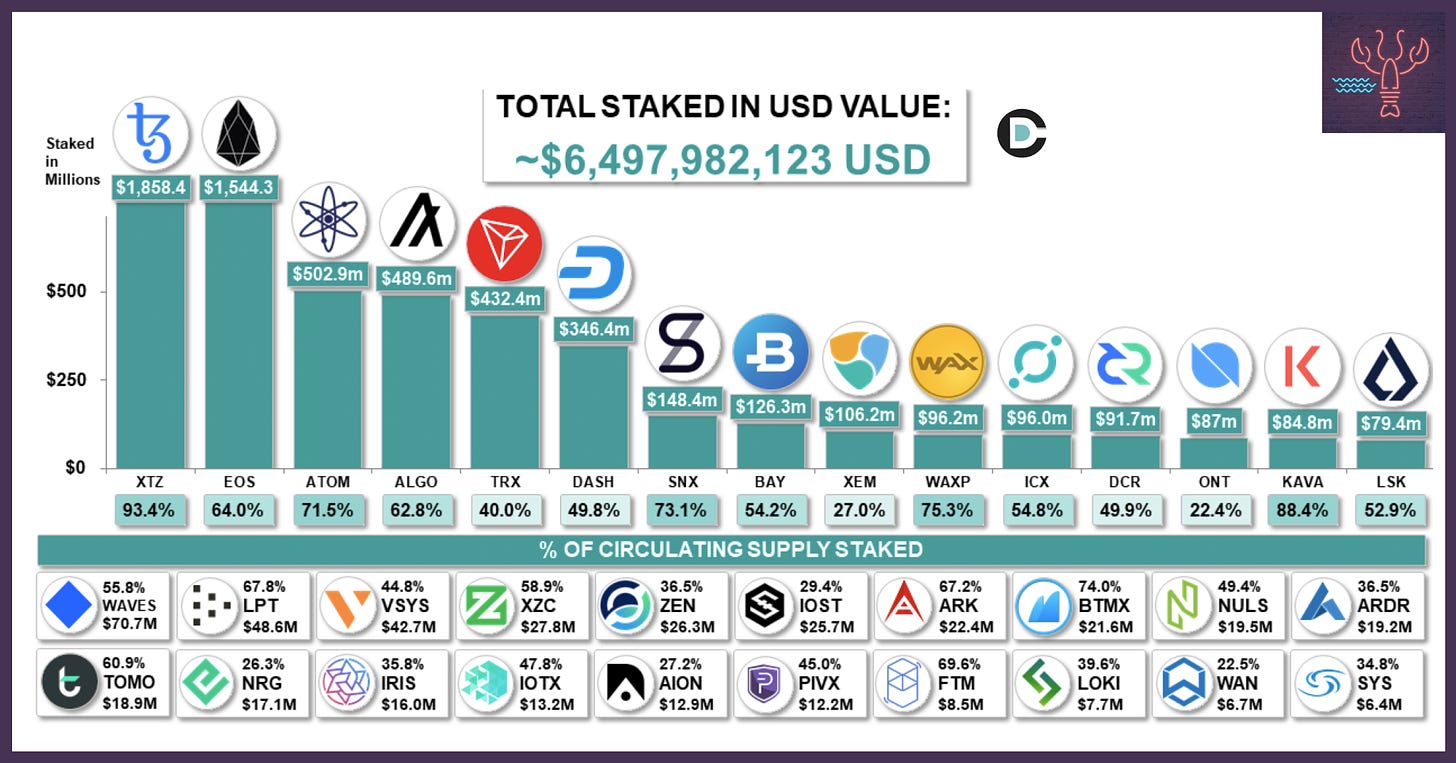

Your coin must be in TOP100 CMC

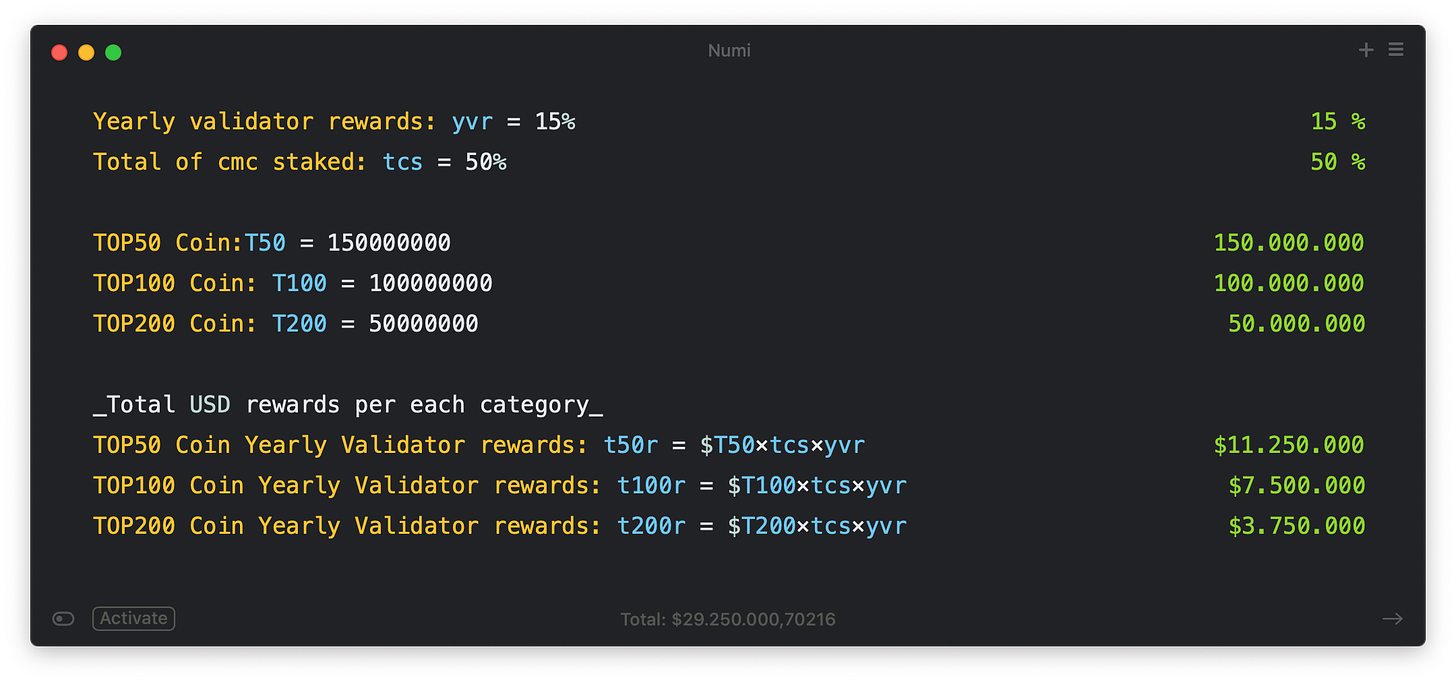

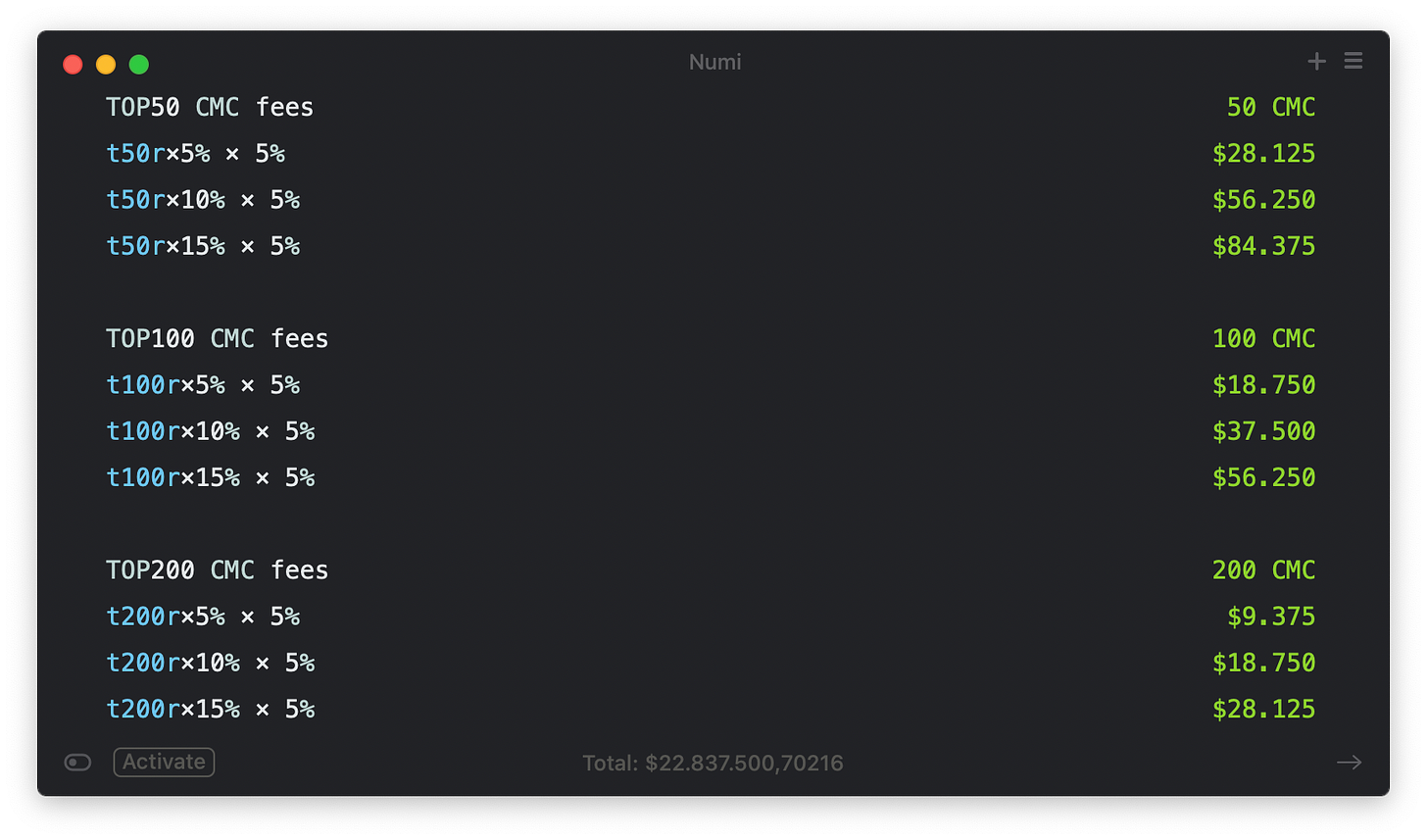

Assuming 15% APR for stakers and 50% of the market cap being staked, that gives us the USD amounts in rewards per year. That is the printing press production that goes to stakers who secure the network, creating continuous cashflow for their work which is not related to network usage or a foundation’s USD balances. A gold mine!

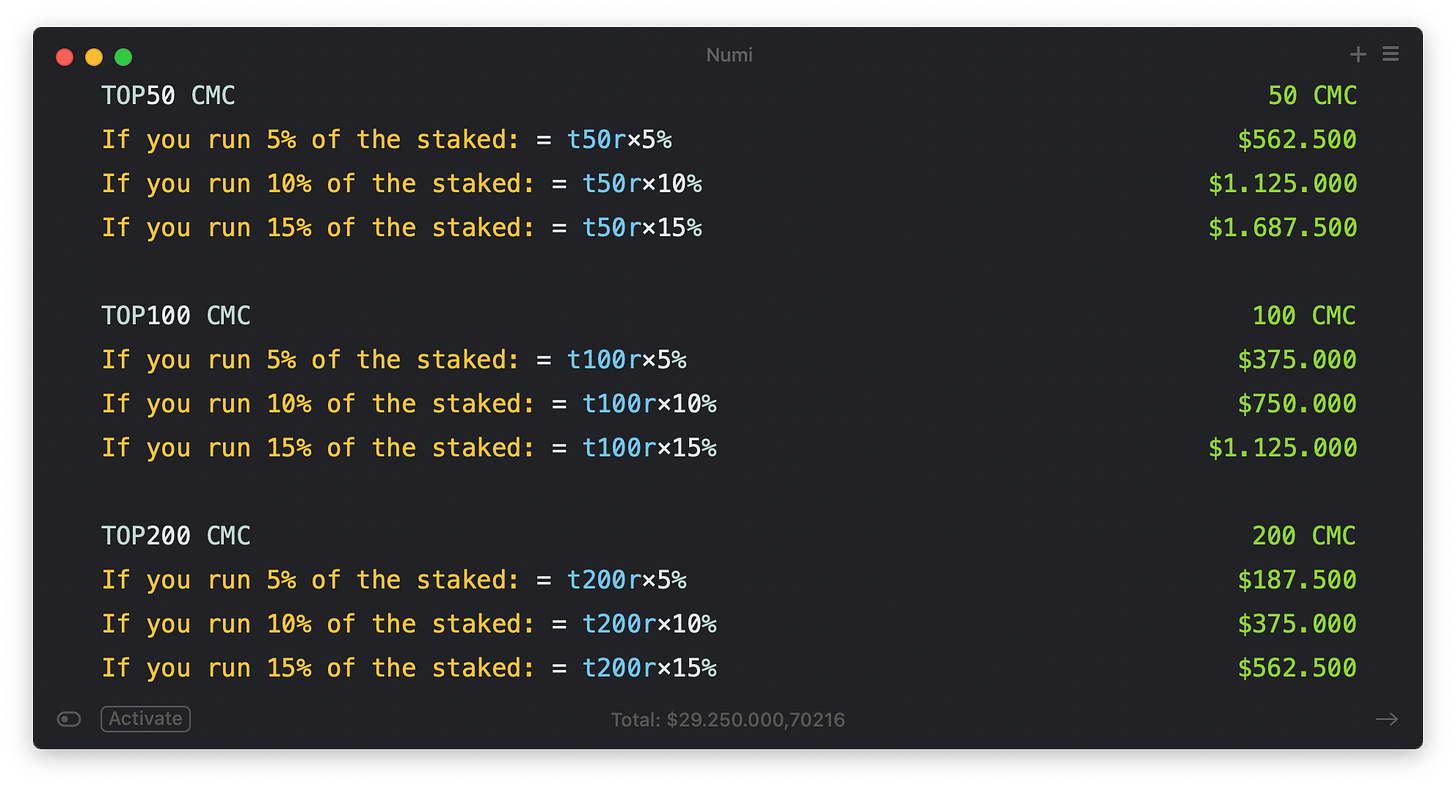

If you go a step further, you could calculate how much the main validators collect in APR rewards. If let’s say you handle 10% of all staked assets, which is usually in top-5 of nodes for any given network, you would be getting up to 1.2M USD in rewards down to 400K USD for a coin just outside of TOP100 CMC.

Now let’s get to the part where validators make their bread and butter. Validators receive commissions from the rewards that the node receives. It could be 3%, 5%, sometimes 10%, but usually not much higher than that.

The sauce of article:

Take into account that validators quote about 800-2000 USD of operational costs (dev work, hosting costs, etc.) per network per month. That means the commissions in fees they receive must be equal to over 20,000 USD per year minimum. Therefore, you simply can’t have professional validators if you are a coin outside of the TOP100. More precisely, you must have CMC of at least 50M USD.

This long journey of numbers was to demonstrate something much more clear: professional validators cannot support unit economics of staking on smaller networks. They cannot justify the efforts. For instance, Cosmos is a more complex network and requires more work: these numbers might give you more insights. If you as a project want these guys, you need to somehow make up for your CMC shortage.

So how can one game this?

Vertical Integrations in Validators

It becomes quite obvious that staking game is to be won by those parties that can take advantage of vertical integrations. For example, exchanges add staking both as a way to keep their relevance and as a way to make sure AUM (assets under management) retains. In fact, AUM is one of the key metrics next to volume, users, and so on.

Sometimes you see reputable validators on smaller coins, so it depends on how they capitalize on the benefits they offer. In total, those usually are:

Exchanges - need to keep their AUM.

Investors - VCs need to funnel their assets to be productive in order to justify it to their LPs. Or the validator team could have personal bags.

Paid USD - validators could be sponsored by core teams, meaning the project pays for either in USD or oversized foundation delegation;

Foundation Grants - core protocol development, where validators receive grants for their loyalty plus the technical work they do for the protocol.

Keeping up your relevance as a validator is extremely hard, as with time your competition grows and the margins get squeezed into equilibrium. So you have to keep adapting to new blockchains, as well as try to upsell on tech integrations and other work you could do for a potential client. Not an easy business.

Should you even care about professional validators?

Virtue signalling or actual support

One can say that service providers always flock to a profitable yard, but sometimes you need to use the reputation of those providers to nurture your young yard. Attract them to your staking, that is. While you can say most networks don’t need professional team of techies, such network like Tezos and Cosmos - especially when slashing is present - require a proper team to secure against downtimes.

Next to that, such validators bring in:

Reputation based on the previous communities they served;

Network of investors and whales who pay attention to them;

Tech community building tools in order to improve the ecosystem overview and welcome open-source developers with the buzz and sexiness of traction.

So if you can get one of these cool validator teams on your side, it surely won’t be bad :)

Some trends and thoughts about staking 🦄

-> Staking AUM growth doesn’t really come from people buying tokens on the market in order to stake, usually it’s just a retention mechanism for existing holders where you tell them about the bright future in order to save your high valuation from sell-offs. It’s a ticking time-bomb… but what is not?

-> Following the previous point, high APR [over 30%] can be neglected as negative because projects like SNX and others proved that people are willing to stay in the game for longer if you keep adding new sexy narratives to the project. So the term unsustainable is likely not applicable in reality. You CAN get away with brrr printing. As much as I hate saying this, data proves it.

-> Staking has turned into an airdrop meme. Staking started as a scalability-security model, but quickly turned into an airdrop meme. Now projects blatantly make it work like an airdrop for holding and not selling. However, for the retail the process is the same as they don’t look beyond the passive income meme - so they roll with that name.

-> Some exchanges abuse staking as “passive income” which is what every investing joke eventually goes into, thus attracting retail into making passive 10% a year. Staking is everything but passive income, and (depending on the timeframe) your 10% APR results in overall 50% loss in the basis investment relative to USD.

-> While with fiat printing brrr machine you also make money close to out of thin air, you are somewhat forced spend it on goods and services within the economy only - unless the currency is very weak. In crypto, the rewards get exchanges for BTC or USDT, making the money flow out of the ecosystem more so than intended. The hope is that the non-monetary value generated (in terms of using the chain) + the new users it attracts, exceeds the cost of paying off validators.

Don’t view staking as passive income, view it as a way to beat inflation at the expense of non-working members if you are holding the coin already. The real economic production of said networks is close to zero. Check more in my LTO article.

There is now plenty of cool research on the staking vs lending security implications, liquid staking, and more. As always, the posts I write tend to be too skeptical-negative, but staking is an interesting part of the industry helping bootstrap ecosystems. Be safe, ride the waves if you can, but don’t become the yield.

That’s it for today. As always, we are mostly Telegram deep sea dwellers, so find us there. Here is the channel with all the relevant links for you to check.

Happy swimming!